Strong Earnings and Favorable Inflation Readings: What's Next for U.S. Equities?

-

We are now in the final peak week of the Q2 earnings season, S&P 500® EPS growth continues to improve, now at 11.8% YoY

-

A cooler-than-expected inflation read also helped give markets a boost this week

-

A few S&P 500 companies reporting in the remainder of the season have outlier earnings dates, including: Agilent Technologies, Synopsys, MongoDB

Strong Q2 Earnings Season Continues with Upward Revisions

As we move through the final peak week of earnings season, the blended growth rate for S&P 500 has now moved into the double digits, hitting 11.8% with 90% companies reporting.1 Thus far 81% of companies have beaten expectations on the top and bottom-line, well above historical averages over the last 1, 5 and 10 years.2

Forward looking guidance has also come in better-than-expected, pushing analyst estimates for Q3 earnings higher. Currently, analysts polled by FactSet expect Q3 S&P 500 EPS to come in at 7.2%. And it's not just Q3 estimates that are increasing, but CY 2025 expectations are up as well. Very infrequently do we see the sell-side raise expectations during the calendar year. In fact, 2025 estimates have declined ahead of every reporting season (Q3 & Q4 2024, Q1 2025) in the last 12-months, with the exception of Q2 2025. CY 2025 EPS growth currently stands at 10.3% vs. the end of Q2 (June 30) when growth was anticipated to come in at 8.9%. According to FactSet, 6 of the S&P's 11 sectors have seen estimates bumps, with Communication Services, Tech, Financials and Consumer Discretionary seeing the most meaningful increases.3

Speaking of Consumer Discretionary, the sector (XLY) has just slightly underperformed the S&P 500 since the April 8 lows (28.5% vs. 29.2%) and will wrap up the earnings season when retailers begin to report next week. This will give us a much needed read on the state of the US consumer, especially in light of recent weaker-than-expected jobs reports.

A Favorable Set Up for US Equities Going Into the End of the Year?

Strong Q2 earnings and rising expectations for Q3 and 2025 are largely due to robust performance from U.S. tech companies and renewed investor interest in the sector following its Q1 slowdown. Technology (XLK) is one of only two S&P 500 sectors to outperform since the April 8 low, up 49.1% compared to the index's 29.2% gain. The momentum in U.S. tech appears set to continue absent any major external shocks. Solid corporate fundamentals and earnings results are positive indicators heading into the end of the year.

Another encouraging development is the current trend of interest rate cuts. Earlier today (Tuesday, August 12), CPI data surpassed expectations, with the consumer price index rising 2.7% on an annualized basis in July, lower than the Dow Jones estimate of 2.8%.4 This milder inflation report boosted markets, fueling hopes that the Federal Reserve will proceed with a rate cut at its September meeting. The CME Group's FedWatch tool now indicates a 91% probability of a September rate cut.5

The combination of upward-trending earnings and (potentially) downward-trending interest rates creates a favorable environment for the broader U.S. equity markets.

On Deck This Week

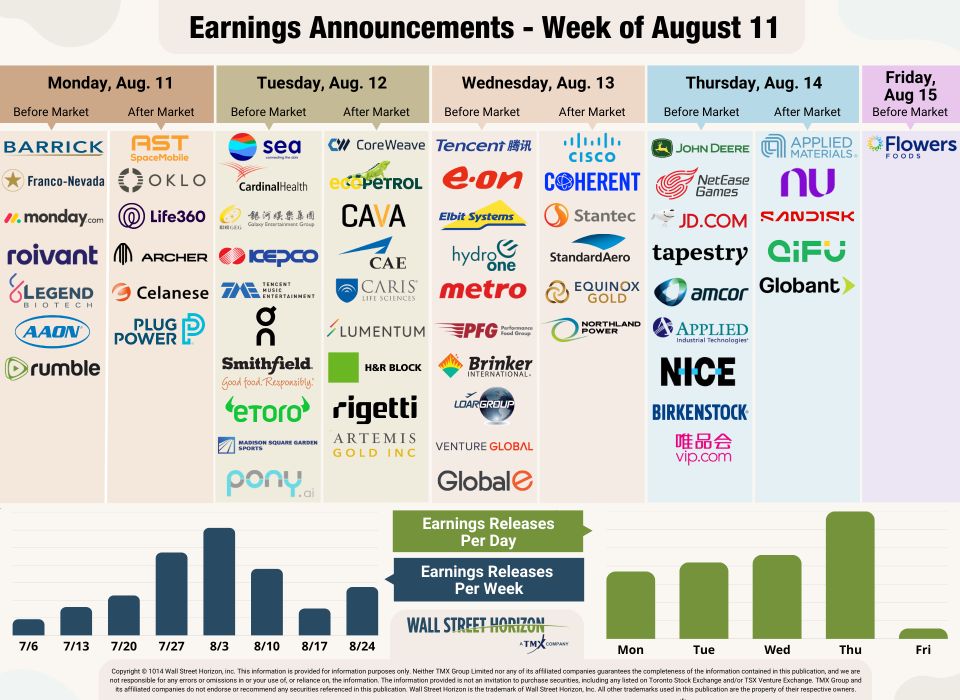

The final peak week of the Q2 earnings season will see results from 2,300 companies (out of our universe of 11,000+ global equities). The busiest day of the week is anticipated to be Thursday, August 14, when 699 companies are set to report. This day we will get a peek at the state of the consumer when Tapestry and Birkenstock share their results.

Source: Wall Street Horizon

Outlier Earnings Dates in The Remainder of Q2 Earnings Season

Academic research shows that, when a company confirms a quarterly earnings date that is later than when they have historically reported, it's typically a sign that the company will share negative news on their upcoming call, while moving a release date earlier suggests the opposite.6

In the next few weeks we get results from some large companies on major indexes that have pushed their Q2 2025 earnings dates outside of their historical norms. Three companies within the S&P 500 confirmed outlier earnings dates for the rest of the season, two of which are later than usual and therefore have negative DateBreaks Factors*. Those names are Agilent Technologies (A) and Synopsys Inc (SNPS). The only name that has advanced their earnings date is MongoDB Inc. (MDB).

Source: Wall Street Horizon

1 FactSet Earnings Insight, John Butters, August 8, 2025, https://advantage.factset.com

2 FactSet Earnings Insight, John Butters, August 8, 2025, https://advantage.factset.com

3 FactSet Earnings Insight, John Butters, August 8, 2025, https://advantage.factset.com

4 July 2025 Consumer Price Index, U.S. Bureau of Labor Statistics, August 12, 2025, https://www.bls.gov

5 CME Group FedWatch Tool, August 12, 2025, https://www.cmegroup.com

6 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Copyright © 2025 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. This publication shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.