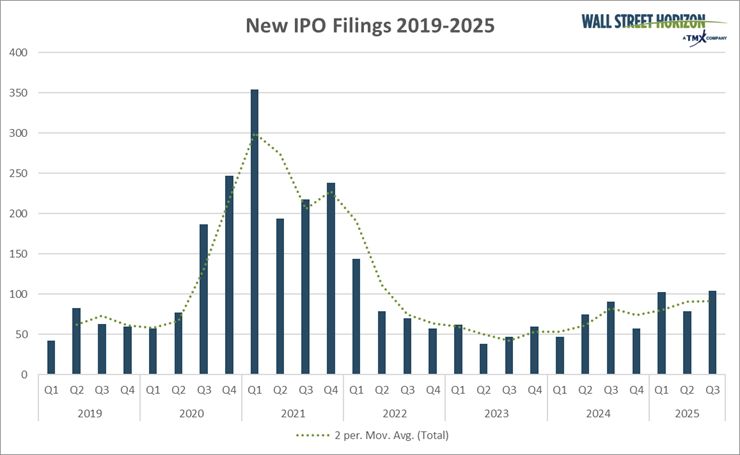

US IPO Activity on Track for the Best Quarter Since Q1 2022

-

Q3 2025 IPO filings have reached 104 with two weeks left in the quarter, making it the strongest quarter since Q1 2022

-

After six large public offerings hit the tape last week (KLAR, FIGR, LGN, VIA, GEMI, BRCB), all eyes are on expected debuts from StubHub and Netskope this week

-

An anticipated Fed rate cut on Wednesday could fuel the fire of public debuts even more as we head into Q4 and 2026

Last week's barrage of IPO activity continues this week with expected debuts from Stubhub and Netskope.

According to our IPO data, licensed from IPOScoop, six companies IPO'd last week, kicking off with the long-awaited debut from Swedish payments company Klarna (KLAR) on Wednesday. That was followed by stablecoin issuer Figure Technology Solutions (FIGR) on Thursday, and the foursome of HVAC company Legence Corp (LGN), transit tech software company Via Transportation (VIA), Winklevoss twin cryptocurrency exchange Gemini Space Station (GEMI) and coffee chain Black Rock Coffee Bar (BRCB) on Friday.1

This brought the total number of Q3 IPO announcements to 104, making it the strongest quarter since Q1 2022.

Source: IPOScoop via Wall Street Horizon

The Promise of Rate Cuts and Strong Stock Market Returns Fueling 2025 IPO Activity

The dryspell in IPO activity since the 2021 boom largely had to do with higher interest rates that made borrowing capital more costly, and the availability of private-market funding. Some well-known unicorns such as OpenAI and SpaceX have benefited from those massive private inflows, making a public debut less necessary.

Because of these two factors, as well as uncertain macro conditions, many companies that debuted last week ended up staying private longer than anticipated. In fact, there have been whispers since 2021 that Klarna was looking to go public, their most recent delay in April 2025 was due to tariff risk uncertainty.2 Now these names have grown more established and are able to raise larger amounts of money, a notable tailwind. And despite the remaining headwinds, which includes uncertainty around US trade policy, a waning labor market, and softening consumer sentiment, the very high probability of Fed rate cuts paired with a stock market hovering at record highs has fueled interest in new issues.

It also helps that those names that have debuted this year have done, on-average, very well. The same can't necessarily be said about those IPOs that came out in 2023 and 2024. Standouts this year include Coreweave (up 200% YTD), Circle Internet (up 57% YTD). And while many names such as Figma and Bullish are down from their initial pop, they remain well-above where they were initially priced, 60% and 40%, respectively. The Renaissance IPO ETF has outperformed the Nasdaq since its April 8 lows. Year-to-date it is up roughly 18.2% vs. the Nasdaq's 16.8% gain.

All Eyes on Expected Debuts from StubHub and Netskope

This week all eyes will be on ticket reseller, Stubhub, which is expected to begin trading on Wednesday, September 17 and cybersecurity company, Netskope, which is expected to begin trading on Thursday, September 18.

Like Klarna, StubHub also tabled its IPO plans in April after President Trump's "Liberation Day" announcement sent markets in a tizzy. This will be the company's third attempt to go public, this time with a valuation that could surpass $9.3B. Last week the company said it seeks to raise $851M by selling roughly 34 million shares in a range of $22 - $25 each.3 Similarly, Netskope has said it aims to raise $813M by selling 47.8M shares priced between $15 - $17 each.4

The Bottom Line

With the successful debuts of many long-awaited IPOs in Q3 2025, the stage is now set for the momentum to continue in Q4 and into 2026, which will especially be true if we see the Federal Reserve cut interest rates on Wednesday as they are anticipated. As Doug Adams, Citigroup's global head of ECM said in a recent Bloomberg interview, "Success breeds success." He went on to say "In a market where IPO issuance is recovering, it's important for deals to work - price well and trade well." That's been working well so far this year, and if macro headwinds don't accelerate and scare off potential public offerings, that should continue as we move into the new year.

1 "Busiest IPO Week Since 2021 Mints $4 Billion for Six Newcomers," Bloomberg, Bailey Lipschultz, September 12, 2025, https://www.bloomberg.com

2 "Klarna, StubHub delay IPOs as Trump's tariffs roil markets," CNBC, Annie Palmer, Leslie Picker, April 4, 2025, https://www.cnbc.com

3 "Ticket reseller StubHub's IPO 20 times oversubscribed, source says," Reuters, Ateev Bhandari, September 12, 2025, https://finance.yahoo.com

4 "Cybersecurity firm Netskope eyes up to $6.5 billion valuation in US IPO," Reuters, September 8, 2025, https://finance.yahoo.com

Copyright © 2025 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. This publication shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.