Netflix Joins the (Much Smaller) Stock-Split Club

-

Traditional stock-split announcements have slowed in the second half of 2025, reflecting more cautious corporate sentiment

-

Netflix's 10-for-1 split bucks the trend as its management signals renewed confidence, despite a sagging stock price

-

Recent splitters like NVDA, WMT, and AVGO saw their shares soar, but CMG shows that bullish results aren't guaranteed

It's been a minute since we've touched on traditional stock splits. Our last look at this type of share-price engineering came in Q2, when reverse ETF splits were happening all around us. For individual investors, when a company's management team chooses to split its stock, it can have more impactful implications for longer-run returns.

Academic research points to pronounced alpha for traditional stock splitters, though outperformance may be diminishing over time. What's more, it used to be that CEOs and CFOs sought to keep their share price in a so-called "optimal" range (usually under $100 but above the single digits) so that the company appeared attractive fundamentally while still allowing individual investors to access shares without breaking the bank.

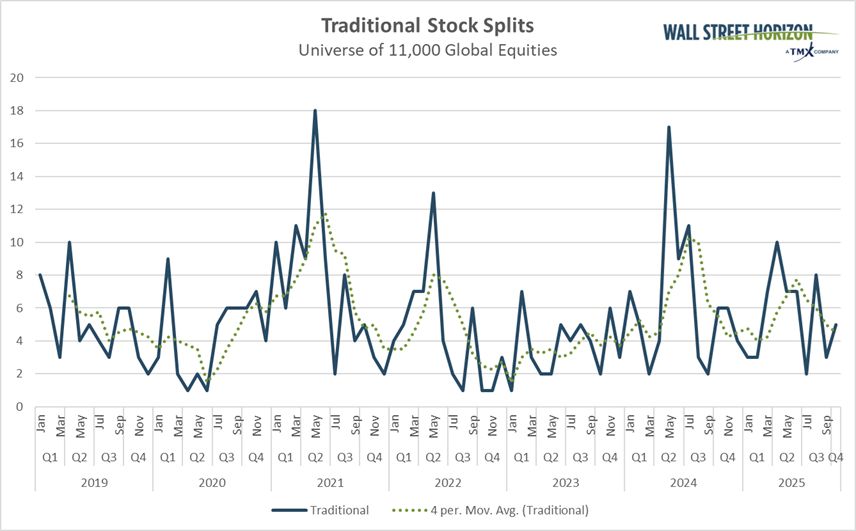

Stock Split Count: 2021 Boom, Post-2022 Lull, 2024 Resurgence, Softer Trends Lately

Source: Wall Street Horizon

A Slowdown Since the 2022 Bear Market

In general, stock-split announcement trends have been fewer lately compared to immediately before the 2022 bear market, hence our sparse updates on this corporate event type. But it's also true that the total traditional equity split count had been positive on a year-over-year basis since Q2 of 2024 before this past quarter.

Recall it was the first quarter of 2022 when splits really captured attention. Then, a series of high-profile glamour stocks, almost in unison, announced traditional splits. Shares of Alphabet (GOOGL), Amazon (AMZN), and Tesla (TSLA) each split, but that seemed to mark the end of the post-COVID split mania.

According to Wall Street Horizon's data, the aggregate number of splits rose from just five in Q4 2022 to 24 in Q2 2025. On a rolling four-quarter basis, the traditional split count peaked at 99 during this year's second quarter. Interestingly, the fourth quarter has tended to be the lightest period for split announcements, giving a year-end reprieve to corporate accounting and investor relations departments.

Netflix Goes 10-for-1

But Netflix (NFLX) bucks the very recent trend. The streaming giant announced a 10-for-1 stock split on October 30, its first in nearly a decade. Perhaps the Communications Services-sector firm sought to swipe attention away from Apple (AAPL) and Amazon, which reported Q3 numbers that evening. No matter the reason, NFLX popped 2% in the session that followed.

Co-CEOs Ted Sarandos and Greg Peters hope that the move mimics the bullish long-term performance that followed the traditional splits of GOOGL, AMZN, and TSLA in 2022. Like those Magnificent Seven members back then, NFLX stock has increased substantially over the past two years, though its momentum has pressed the pause button so far in the second half of 2025.

The $474 billion market-cap movies and entertainment stalwart remains a retail favorite, even with a Q3 earnings miss reported last month (which was primarily due to a one-off Brazilian tax charge). It posted double-digit revenue growth across regions while outlining new targets around content and technology to drive global engagement.1

Other Recent Splitters

Netflix isn't the only S&P 500® constituent to go for a stock split. Earlier this year, Fastenal (FAST) from the Industrials sector and O'Reilly Automotive (ORLY) within Consumer Discretionary did the same. Then, just a day before Netflix's split, software company ServiceNow (NOW) confirmed a 5-for-1 split.

Big picture, just a handful of blue chips have been bold enough to go through with traditional splits, which stands in sharp contrast to the 2021–early 2022 enthusiasm when companies from e-commerce to chipmaking were clamoring to divide their shares. It's tempting to view the lull as a signal of shifting market psychology: executives may be wary of sending an overly bullish message in a world where the jobs market has slowed, valuations have risen, and macro uncertainty remains elevated.

Signal vs. Noise

But be on the lookout for more news around splits come early 2026. That could be a telltale sign that optimism is back. You see, a traditional split doesn't change fundamentals, but it does send a message. Corporate leaders are thought to execute splits when they believe their stock will rise in the years ahead; it's a subtle confidence signal that investors should heed, along with other fundamental trends.

That was likely the modus operandi for three splitters over the past cycle:

-

NVIDIA (NVDA): Its 2021 split preceded a rally of more than 1,300%, with another split spliced in just three years later.

-

Walmart (WMT): The 3-for-1 split in January 2024 helped reignite retail investor attention and preceded solid relative strength versus the Consumer Staples sector (shares are up 87% since then).

-

Broadcom (AVGO): The June 2024 10-for-1 split coincided with record highs and a continued AI-hardware boom. Shareholders since the split aren't complaining about the 155% return.

But not every case has been a winner. Chipotle Mexican Grill (CMG), which split 50-for-1 in 2024, has since lagged as concerns over food inflation and restaurant-sector margins weigh on sentiment. The once high-flying fast-casual restaurant chain reported very disappointing top- and bottom-line results last week2, sending CMG shares cratering to their worst level since Q1 2023. After a brief post-split-announcement rally in 2024, the stock has since wrapped up a burrito-sized loss—down 43% since March 19, 2024.

What Comes Next

The next few quarters will test whether the Netflix split ushers in another mini-cycle of announcements or remains an isolated event. With index levels near all-time highs and volatility generally in check, the backdrop appears ripe for more management teams to consider the optics of accessibility and liquidity.

But as the last few years have shown, stock splits are at best a coincident indicator of market strength and general investor sentiment. The previous cycle's split-count zenith occurred toward the tail end of 2021, near when the average global stock topped. Then, the lowest 12-month split sum happened in Q2 2023, well into the start of the bull market.

The Bottom Line

Netflix stock caught a bid after its stock split announcement, but the jump was modest and short-lived. That's perhaps the state of sentiment today, which is a far cry from late 2021. Back then, low interest rates, SPAC deals, IPOs, and a junk rally marked the end of the post-pandemic bull market. Is the Netflix split news signal or noise? We may find out in Q1 2026 if another wave of traditional splits hits the tape.

1 2025 Quarterly Earnings, Netflix, October 21, 2025, https://ir.netflix.net

2 CHIPOTLE ANNOUNCES THIRD QUARTER 2025 RESULTS, Chipotle Mexican Grill, Inc., October 29, 2025, https://ir.chipotle.com

Copyright © 2025 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. This publication shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.