M&A Momentum: A Hidden Bullish Indicator Heading Into 2026?

-

A slew of corporate deals has sparked optimism heading into the end of the year

-

Regional banks, pharma giants, and consumer brands are driving the latest deal wave

-

Rising M&A volumes may signal renewed corporate appetite for external growth, despite troubled macro waters

Bankers and underwriters have plenty to be thankful for. Bond issuance is running hot, this year's IPO count is up (at least it was before the government shutdown), and interest rate volatility has cooled—potentially paving the way for more corporate dealmaking as we head into 2026. Momentum continues to build on that last front.

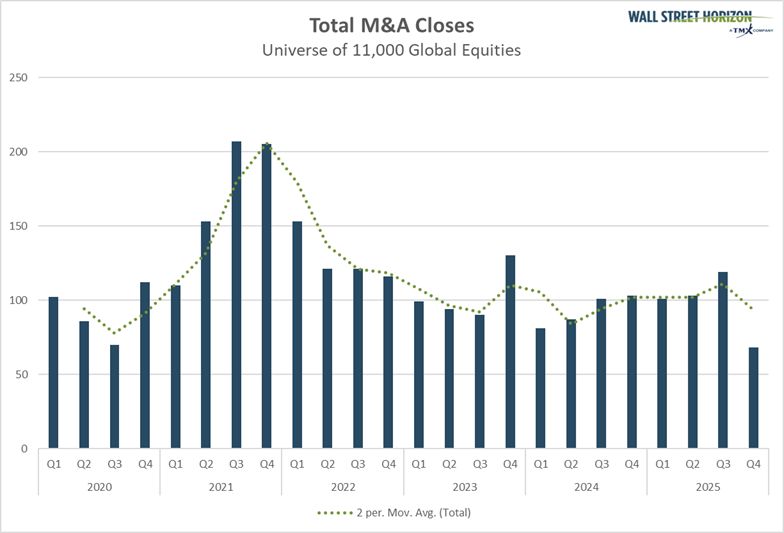

According to Wall Street Horizon's coverage universe of 11,000 global equities, the third quarter of 2025 marked the highest number of M&A closes since Q4 2024. On a rolling four-quarter total, the count is the highest going back to early 2023. A solid finish to the year could take us back to 2022 levels—a period that benefited from the 2021 deal boom. The chart of M&A announcements shows a similar recovery.

A Deal Deluge: Global M&A Activity on the Rise in 2025

Source: Wall Street Horizon

North America appears to be at the heart of the renaissance. BofA Global Research pointed out that North American M&A volumes (on a dollar basis) summed to $348 billion in October. While that was down from $421 billion in September, the six-month average notched the best level since October 2014.1 Zooming in further geographically, Goldman Sachs' team recently estimated that announced U.S. M&A volumes were 35% higher on a year-over-year basis as of early November.2

Is uncertainty high? Yes. Is the macroeconomic foundation shaky? Yes. Are companies seeking creative solutions? It appears so.

What's more, our team dug into the actual transactions (both proposed and finalized). The main message is that M&A is happening across sectors and industries. Health Care collabs are among the most numerous, but we see consolidations in cyclical areas like Financials, Consumer Discretionary, and Materials. Tech is also in the limelight, with an increasing number of firms tapping the bond market to fund AI capex and M&A.

Here are some of the standout deals, and why they matter for investors attempting to get a handle on the state of CEO confidence beyond earnings reports and investor conferences.

Health Care

Pfizer → Metsera

The GLP-1 weight-loss arms race ratcheted up when Pfizer (PFE) acquired Metsera (MTSR). It was quite the saga, and the move strengthens Pfizer's position in a niche that rival Eli Lilly (LLY) has come to dominate. With Metsera's assets and pipeline, Pfizer may simply be aiming to diversify its revenue base, which has leaned heavily on its COVID vaccine in recent years. PFE's fat dividend and slow price climb are welcomed by many of its income-seeking investors.

Merck → Cidara Therapeutics

Also in Health Care, Merck's (MRK) purchase of Cidara Therapeutics (CDTX) adds a long-acting antiviral platform and potential blockbuster flu treatment to its infectious disease portfolio. The $9.2 billion acquisition offers optionality and reinforces Pfizer's vast oncology franchise.

Consumer Staples

Kimberly-Clark → Kenvue

Earlier this month, a major deal crossed the wires between a household name and a recent spinoff entity. Kimberly-Clark (KMB) announced it would buy Kenvue (KVUE) in a $49 billion cash-and-stock deal. Recall that the acquired company had been under intense pressure from the Trump administration regarding Tylenol's alleged health effects on pregnant women. Most experts assert the over-the-counter pain-relief medication is safe, but the story weighed on KVUE shares. KMB is willing to take on the risk. Investors were not enthused, though, as shares plunged from near $120 to under $100 (for a time) after the news broke. The KMB bulls need a Band-Aid.

Financials

Huntington Bancshares → Cadence Bancorporation

Pivoting to more economically sensitive areas, recent M&A activity within the Regional Banks industry is encouraging for the macro bulls. They say that banks are sold, not bought (meaning acquisitions are more common amid market stress), but when Huntington Bancshares (HBAN) confirmed its intention to purchase Cadence Bank (CADE) for $7.4 billion, it was seen as a positive. The acquisition strengthens HBAN's southern U.S. footprint.

Fifth Third Bancorp → Comerica

Another regional banking deal landed early in Q4. Fifth Third Bank (FITB) announced it would buy Comerica (CMA) in a $10.9 billion all-stock deal. Assuming the acquisition is completed, it would be one of the largest regional-bank mergers in years, creating a more geographically diversified FITB with a significant presence across the Midwest and Texas.

Charles Schwab → Forge Global

On the brokerage side, Charles Schwab (SCHW) is investing in Forge Global (FRGE). The purchase provides the $168 billion market cap financial services firm with direct access to private-market trading infrastructure, an area gaining traction as more late-stage companies remain private for longer. Forge also specializes in secondary trading of private shares, potentially laying the groundwork for Schwab to offer its clients earlier access to early-stage companies.

Consumer Discretionary

TriArtisan Capital / Treville Capital / Yadav Enterprises → Denny's

Schwab investors may be pleased with returns across stocks and bonds so far this year, but it's clear that there's angst among many consumer cohorts. Lower- and middle-income households struggle as the "K-shaped" economy gets increasing attention. In a private-equity-led buyout, Denny's (DEN) will likely undergo restructuring. The restaurant company has struggled with traffic and modernization, making a private-equity turnaround appealing. Will it turn out to be a grand slam? Time will tell.

Materials

Coeur Mining → New Gold

Wrapping up with a glittering slice of the global commodity market: gold. On November 3, Coeur Mining (CDE) announced plans to buy New Gold (NGD) in an all-stock transaction. The deal offers Coeur a potential operational advantage and boosts its reserves at a time when gold prices remain high, near $4,000 per troy ounce, on geopolitical and macro uncertainty. Gold miners more broadly boast stronger balance sheets than previous cycles, and with higher free cash flow (given gold prices), executives in the industry have plenty of capital-deployment options.

The Bottom Line

These are just a handful of many recently announced M&A transactions. Could it be a bullish signal as year-end approaches? Perhaps. CEOs and CIOs are venturing out on the risk curve for growth beyond organic means. Surely not all of the deals will work out to a T, but after many quarters of quiet M&A volumes, activity has turned up meaningfully lately.

1 BofA Global Research, BofA Securities, November 18, 2025, https://business.bofa.com

2 Goldman Sachs Insights, Goldman Sachs, November 18, 2025, https://www.goldmansachs.com

Copyright © 2025 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. This publication shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.